MPOWER Product Review: Zenbanx

Disclosure: MPOWER received zero sponsorship for this blog post and all opinions are our own.

The team at MPOWER is always looking for new tools that can help our borrowers with their finance and education journeys. Paying student loans can be a hassle, especially when borrowers come from overseas.

What Is Zenbanx?

Over the past few months, we’ve been testing out Zenbanx, an online banking and currency transfer system. Zenbanx allows U.S. residents to open bank accounts that hold nine different currencies while also earning competitive interest. This can make planning for college costs abroad less of a worry for both U.S. students studying elsewhere and foreign students studying in the U.S.

The nine currencies that Zenbanx supports are AUD, CAD, EUR, GBP, HKD, INR, JPY, SGD, and USD.

All Zenbanx currencies earn competitive interest rates (up to 1.25%), with the exception of JPY and SGD, which do not earn any interest.

Zenbanx At A Glance

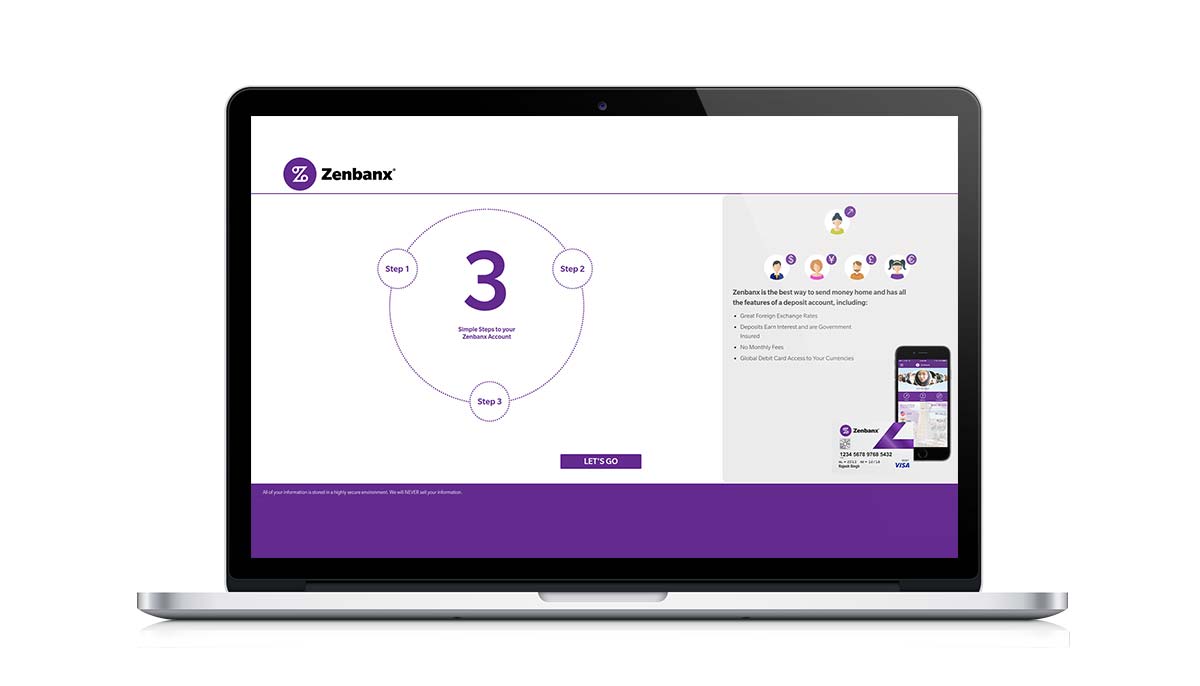

Opening a Zenbanx account online took less than 10 minutes and was an easy process, with no minimum balance or deposit required. Creating our account simply involved answering a few identification questions, uploading a photo, and linking to a current bank account. Our Zenbanx account was then accessible on our desktop web browsers as well as on our mobile phones, with a user interface that was simple and straightforward.

What Are The Benefits of Zenbanx?

In addition to customers being able to hold multiple currencies and earn interest, what makes Zenbanx especially appealing is the ability to transfer funds between Zenbanx customers. This service is available for free within the U.S. and costs $0.95 USD between international Zenbanx customers. In-network Zenbanx transfers are immediate and funds are available as soon as the a customer clicks the “accept” button to receive funds. Paying student loans or covering college costs using Zenbanx makes it easier for current students or recent graduates – families can transfer cash with minimal fees by simply clicking a button.

Zenbanx also gives customers the option to use a Zenbanx debit card for purchases and withdrawals around the world – a handy tool for someone who is hopping between two or more countries.

Zenbanx charges a $1.75 fee for customers who withdraw funds in a country with a currency not supported by Zenbanx. However, this fee is still much lower than many ATM fees.

The Bottom Line

Overall, opening up and using a Zenbanx account was a stress-free process. It’s a great tool for people who travel frequently or are studying in the US.

Screenshots courtesy of Zenbanx