How international student loans work: Tips for first-time borrowers

Wondering how international student loans work? If you’re an international student planning to study in the U.S., understanding your loan options, interest rates and repayment terms is essential. To help you navigate these confusing waters, we’ve put together this overview of how student loans work for international students in the U.S. Read on to learn how to get an international student loan, how student loan interest rates work and more.

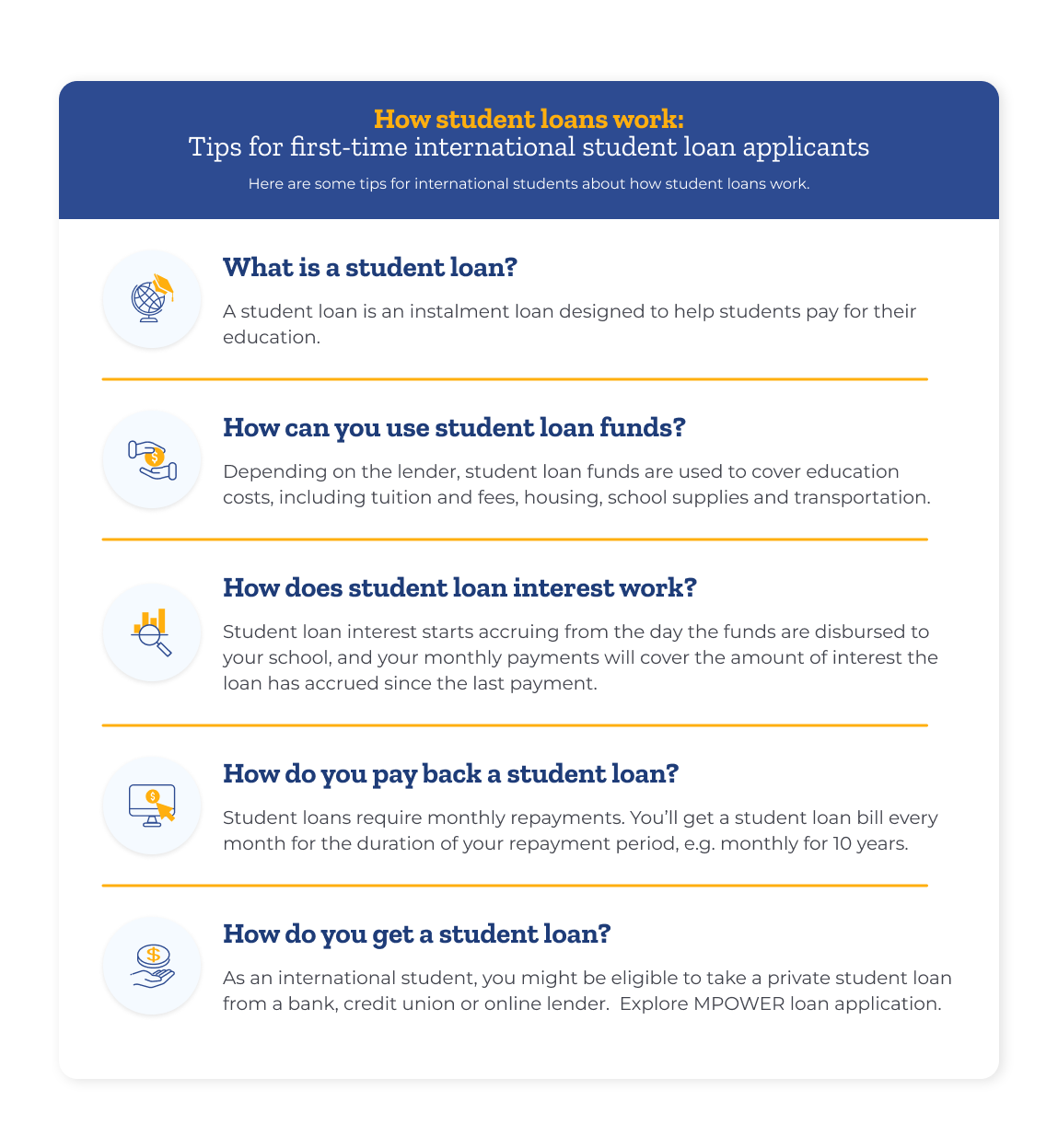

What is an international student loan?

A student loan is a type of installment loan designed to help students pay for education. When you have a student loan, your lender typically sends the money straight to your school.

Your college or university in the U.S. will apply the funds to tuition, fees, room and board, and any other eligible expenses that were specified during the application process. If there’s any money leftover, it may be returned to you so you can use it for books, supplies, and living expenses accordingly (make sure you check with your school to confirm their policies).

Student loans are not free money – you must pay them back with interest. Interest is the cost of borrowing a loan, and it accrues at a fixed or variable rate. Some lenders also charge a disbursement or origination fee on a student loan. It’s important to understand the differences between variable and fixed-rate student loans to decide which option is right for you.

How are student loans different for international students?

American students applying for a student loan in the United States have fewer loan verification documents to submit than student applicants from other countries. As part of the loan application process, international students must submit a visa, which gives them permission to study in the U.S.

Students must first:

This includes knowing what type of visa they need for studying abroad, applying for a visa and preparing for and taking part in a visa interview with the U.S. Department of State.

What can you spend international student loan money on?

You can spend student loan money on your education costs when studying in the U.S., and your school will need to certify the loan amount. These costs will vary from one school to the next, but they may include:

- Tuition and fees

- Housing

- Meal plans and groceries

- Books, laptops, and other supplies

- Transportation

You can also use student loan money to cover your daily living expenses, but it’s important to create a budget and only borrow what you need.

How does international student loan interest work?

As an international student, you aren’t eligible for loans through the U.S. government, but you are able to explore private student loan providers. Most private student loans start accruing interest from the day the funds are disbursed to your school.

Let’s say, for example, that you borrowed US$30,000 at a 13.99% interest rate. Over a 10-year repayment period, your monthly payment would be US$466 and you’d pay a total of US$25,874 in interest charges. Keep in mind that if you choose a lender like MPOWER that allows for interest only payments while in school – those payments will be less.

When you start paying back your student loans, a portion of your payment will be applied to interest charges and a portion will pay down your principal balance. If you can afford to make extra payments, you could pay off your loan faster – which means you pay less interest over the lifetime of your loan. If you plan to pay off your loan early, you will want to find a lender that doesn’t have prepayment fees.

One important item to consider is whether you want a loan with a fixed interest rate or a variable interest rate. Some international student loans are fixed interest rate student loans, meaning the interest you pay will stay the same over the life of your loan. Others come with variable rates, which often start out lower than fixed rates but can increase over time.

How do you pay back an international student loan?

As installment loans, student loans require monthly repayment. You’ll get a student loan bill every month for the duration of your repayment period. A common repayment period for student loans is 10 years, but you might have alternative options when you borrow depending on your lender and terms.

Repayment while you’re in school varies by lender. Some lenders have a grace period on student loans, meaning you don’t pay them back while you’re enrolled in school or for a few months after you graduate. Once this grace period ends, you’ll start making full payments every month. Others have an interest only repayment period, meaning you only make payments on the interest during a certain period, such as while you’re still in school. Keep in mind that the less you pay on your loan while in school, the larger your debt will be upon graduation.

You can usually set up automatic payments on your student loans, giving your lender permission to withdraw payments from your bank account every month on or before the due date. Many lenders offer an interest rate discount if you set up autopay. For example, MPOWER offers a discount of 0.25% for setting up autopay.

How do you get an international student loan?

As an international student, you might be eligible to take a private student loan from a bank, credit union, or online lender. Many lenders will require you to apply with a cosigner who lives in the U.S., has good credit, and has a steady income.

Not every international student has access to a cosigner who lives in the U.S. or wants to ask someone to share debt. At MPOWER Financing, our student loans are designed specifically for international students studying in the U.S. and don’t require a cosigner or collateral.

With an MPOWER student loan, you can apply to borrow up to US$100,000 at a fixed interest rate on a 10-year repayment period. While you’re in school and for six months after you graduate, you will only have interest payments to cover. After this period ends, you’ll start making full payments toward both interest and your principal balance.

You can apply for an MPOWER student loan online as it’s a fully digital process. Depending on your situation, you could get your student loan approved and funded in as little as two weeks. See our article on when to apply for international student loans for more information about loan processing timelines.

Learn more about student loans from MPOWER Financing for international undergraduate and graduate students.

Interested in applying for an international student loan through MPOWER Financing?