Healthy, Wealthy, And Wise: The Student Loan Edition

Managing your finances can be intimidating, especially if you’re a student or recent graduate just beginning to become financially independent. With everything you’re balancing right now – school, work, friends, family, hobbies – your financial health might not be a top priority. You probably think that when you’re older and wiser you’ll magically have a solid grip on your finances. But understanding your finances and getting them in order now will be immensely helpful later, when managing your financial affairs becomes even more complicated.

This blog post is the first in a series that lays the groundwork for a financially healthy life. The sooner you start building on your financial education, the more empowered you’ll become. This means that you can avoid the common pitfalls that many millennials make. To get you started, we outline helpful student loan terminology below.

Student Loan Terminology (And Some Other Helpful Financial Terms)

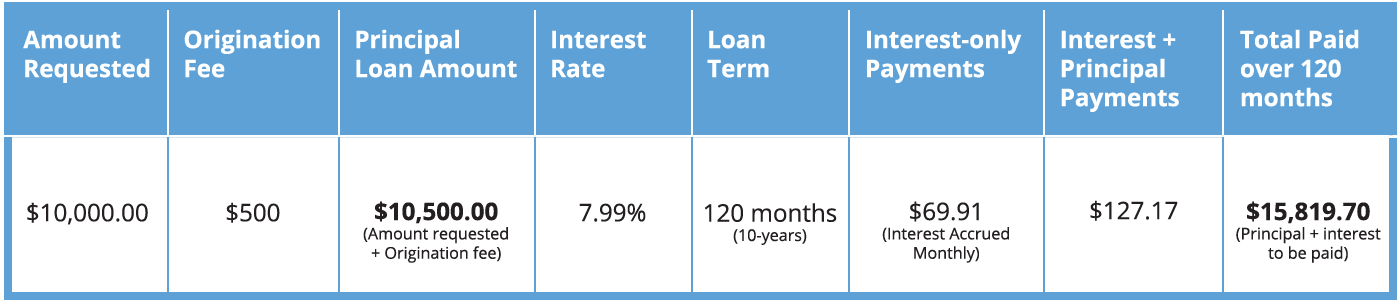

Accrued interest: Accrued interest is the interest on a bond or loan that accumulates after a loan is taken out or a principal investment is made.

ACH: ACH, or Automated Clearing House, is an electronic network used to process financial transactions automatically.

Capitalization: Capitalization is the unpaid interest that is added to the principal balance of a loan. Future interest is charged on the increased balance and may increase monthly payment amounts and the total amount repaid over the life of the loan.

Co-signer: A co-signer is an individual (typically a parent, spouse, or other close friend or family member) who commits to paying back a loan if you do not or cannot.

MPOWER Pro-tip 1

MPOWER loans never require a co-signer – be sure to reach out to us if you are are trying to secure a no co-singer loan!

Consolidating: Consolidating is the process of combining multiple loans into one big loan. For example, if you have three student loans, you can combine them into one.

Credit score: A credit score is a number between 300 and 850 that measures your credit risk. This score serves as an indicator to lenders on how likely you are to honor your financial commitments. The higher your credit score, the better.

MPOWER Pro-tip 2

It’s important to build up your credit score over time. You can do so by paying off your credit cards and loans consistently. Check out NerdWallet’s article on how to build credit for some other helpful tips.

MPOWER Pro-tip 3

It’s a good idea to check your credit score at least once a year to make sure it’s accurate. You can do so for free at www.annualcreditreport.com through the three main credit reporting agencies: Experian, Equifax, and TransUnion.

Deferment period: A deferment period is a designated amount of time a borrower does not have to pay either the interest or the principal on a loan. Student loan deferment is common while a borrower is still in school. Also called a deferral.

Fixed-rate loans: Fixed-rate loans have interest rates that do not change over time. When you take out a fixed rate loan, you know exactly how much interest you’ll be paying for the duration of the loan.

Forbearance: Forbearance is a designated period of time in which you are not required to make payments on your loan due to economic hardships. Some examples that would allow you to qualify for forbearance are becoming unemployed, or in cases where you have fallen extremely ill.

Grace period: The grace period is a designated amount of time that a lender gives a borrower before principal payments need to be made.

Interest-only payments: Interest-only payments are when a borrower only pays the interest on a loan. Generally, this type of payment is only allowed for a fixed amount of time, and then the borrower is required to pay back part of the principal of a loan, in addition to interest.

Origination fee: An origination fee is a fee that is charged by a lender in order to process a loan application. Typically an origination fee is a percentage of the total loan amount.

Principal: The principal is the amount that is owed on a loan, not including interest.

Refinancing: Refinancing is the act of replacing your current loan with a new loan that has better terms.

Repayment Term: The maximum time period over which a loan must be repaid.

MPOWER Pro-tip 4

Use a student loan payment calculator, like the one on www.smartborrowing.org, to figure out what your loan repayment period looks like.

Variable-rate loans: Variable-rate loans have interest rates that change over time, based on other current predominant interest rates.

As always, we’re here for you if you have questions.

Thanks to www.investopedia.com for helping define these terms!